We Buy Houses Ohio

“Sell My House Fast For Cash!”

Sell your house fast in Ohio and pay no agent fees or costly repairs. Check out how our home-buying process works!

EZ Sell Homebuyers is owned and operated by Mike Wall and Jay Thoms, trusted local cash homebuyers based in Ohio. Mike Wall is a licensed Ohio real estate professional (Ohio Division of Real Estate License #2001023573). Together, they specialize in helping homeowners sell their houses fast and stress-free. With decades of combined experience buying houses in Ohio, Mike and Jay have helped hundreds of sellers close quickly, even in difficult situations such as foreclosure, inherited homes, hoarder houses, and major repairs.

Unlike large national franchises, when you work with EZ Sell Homebuyers, you work directly with the owners. That means honest answers, real decision-makers, and a simple, transparent process from your first call to the day you get paid. Having closed over 1,700 home sales, EZ Sell Homebuyers is one of the most experienced home-buying teams in the Ohio.

How Do I Sell My House Fast in Ohio?

Sell your Ohio house for cash with our easy 3-step process.

Contact Us

Contact Us

Send Us The Address By Filling In The Form

Get Your Offer

Get Your Offer

We’ll schedule a date to check out your house

Get Your Cash

Get Your Cash

We’ll Make You An Offer And If You Like The Offer, Just Pick A Closing Date

Sell Your House Fast in Ohio for Cash – No Fees, No Hassle

The easiest way to sell your house fast is to contact our Ohio team. We’ll make sure that you get the best possible price so that you can get rid of your unwanted home for cash.

We buy houses in Ohio as-is. There are no commissions or hidden fees, and you can sell your house fast, within your timeline! If you still have questions, call us at 937-598-CASH or fill out our short form below.

How We Buy Houses in Ohio

Whether you’re facing foreclosure, dealing with an inherited property, relocating for work, going through a divorce, or simply need to sell a house that needs major repairs, we can help. As experienced cash home buyers in Dayton, we’ve helped hundreds of homeowners sell quickly without the stress of traditional real estate listings.

Our process is simple: contact us today, receive a fair cash offer within 24 hours, and close on your timeline—often in as little as 7 days. There’s no need to make repairs, clean, or even move everything out. We buy houses in any condition throughout Springfield and the surrounding Montgomery County area.

Unlike traditional home sales, you won’t pay realtor commissions, closing costs, or repair expenses. What we offer is what you get. We handle all the paperwork and make the entire process as smooth as possible so you can move forward with your life.

Sell Your Ohio House Fast For Cash

We Buy Houses In Ohio In All Situations

Avoiding foreclosure

Avoiding foreclosure

If you’re facing foreclosure in Ohio, selling your house may be a smarter choice rather than letting the bank take it back. We understand that time is critical and can make you a cash offer.

Too many repairs

Too many repairs

Are there too many repairs needed to sell your house? We’re ready to make a cash offer whether there’s fire damage, the roof needs repairs, the electrical system is faulty, or the windows need to be replaced.

Inherited a house

Inherited a house

Inheriting a house in Ohio often means taking on monthly mortgage or tax payments, along with the complexities of probate. Selling your home to us for cash might be the easiest solution.

Going through divorce

Going through divorce

Going through a divorce and need to sell your house fast? We can close in as little as 7 days and work directly with your attorneys. Learn how to sell your house fast during a divorce in Ohio.

Relocating

Relocating

Did you receive a job offer with little or no warning and need to sell your house fast? We can buy your house and get you the cash you need. You have the flexibility to choose your closing date and sell before or after you leave.

Tired of tenants

Tired of tenants

Are you tired of dealing with tenant damage to your property or chasing them for overdue payments? It might be time to consider selling your house with a tenant in Ohio.

Homeowners All Over Ohio Loved Our Offers, And So Will You

Micah Green 12 days ago

12 days ago

Mike & Jay were awesome to work with. It was super simple and saved me a ton of work.

1

1

Share

Share

Gayle Baxter 1 month ago

1 month ago

So glad I found them. They made me a good offer on my house, we closed 3 weeks later.

3

3

Share

Share

Phebe Fischer 3 years ago

3 years ago

A+ would definitely recommend if you need to sell quickly. This was the second house we sold them.

1

1

Share

Share

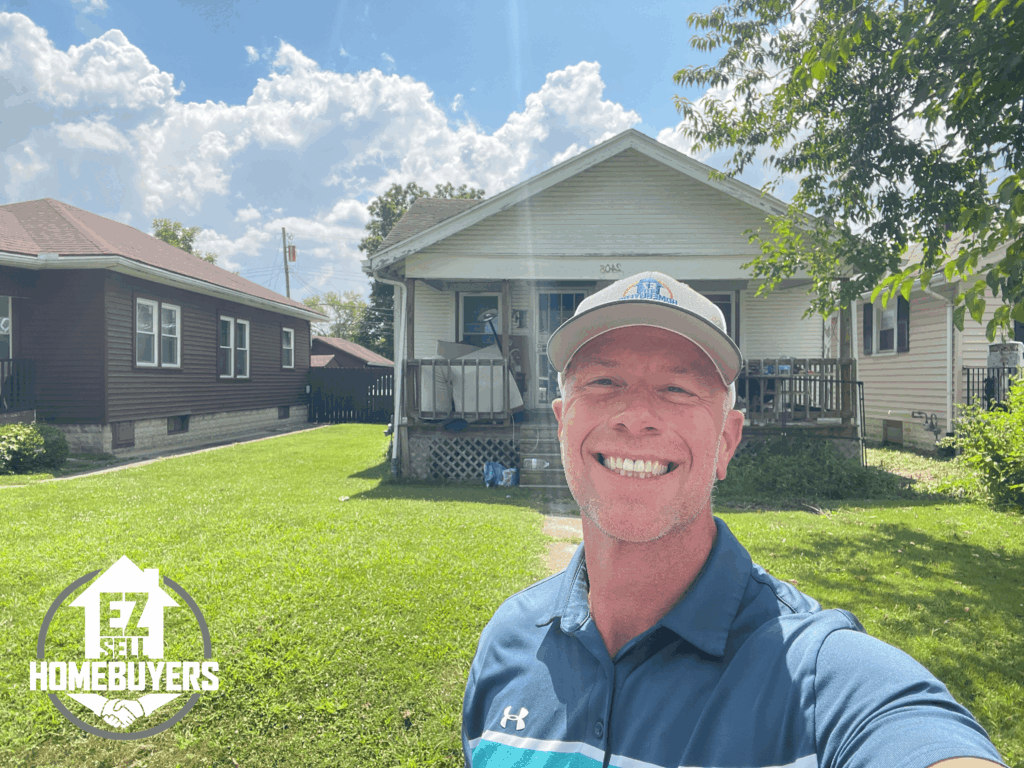

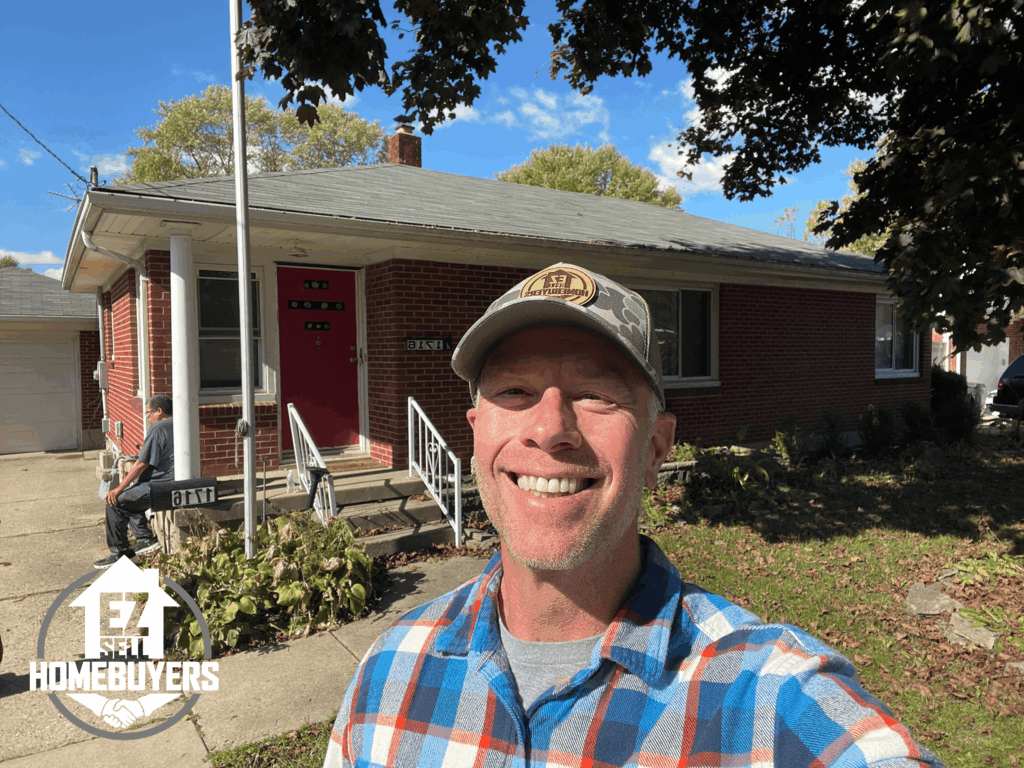

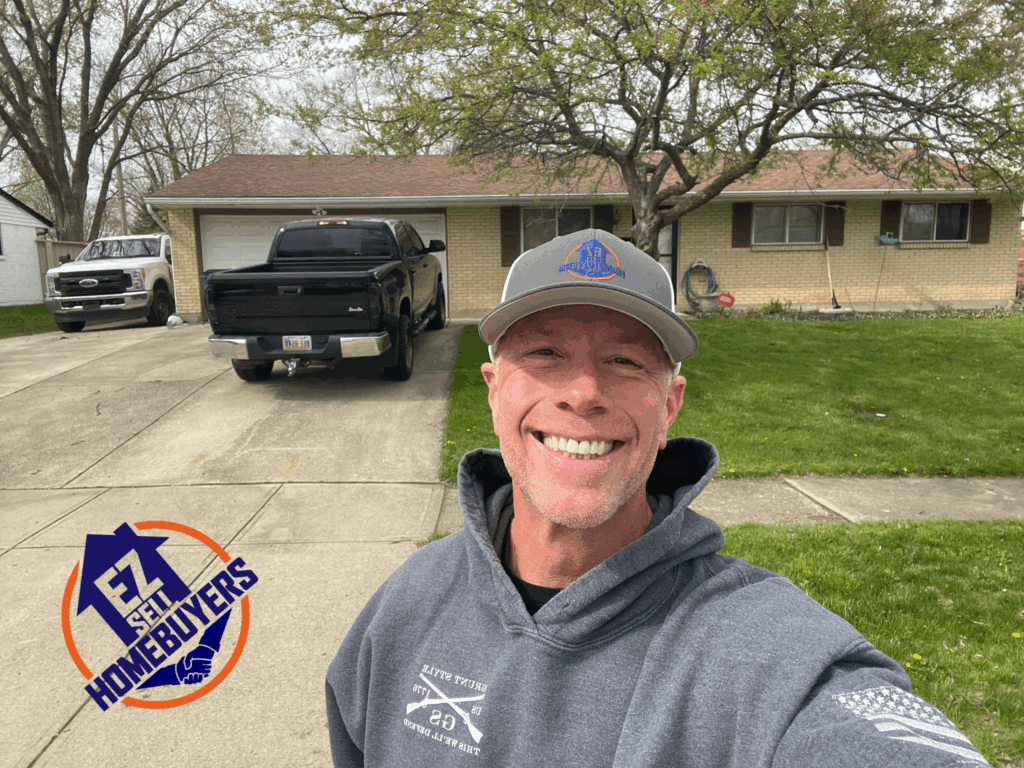

See Your Ohio Home Sold: A Gallery of Our Recent Cash Closings.

If you need to sell your house fast in Ohio, we have a proven track record of over 1700 homes that we have purchased for cash. See below for just a few examples. Every home you see here was purchased directly from a local homeowner, many facing tight timelines, major repairs, or difficult life transitions.

Case Study: Helping Brandon Sell Fast on Cedar Knolls Drive to Care for Family

The Property: 7371 Cedar Knolls Drive, Dayton, OH

The Seller: Brandon R.

The Investor: Mike Wall, EZ Sell Homebuyers

The Challenge: Needed a high-speed sale to relocate and care for a sick family member.

The Situation: When Family Comes First

Brandon was facing a major life transition. His mother had fallen ill, and he needed to move quickly to become her full-time caregiver. Owning a home on Cedar Knolls Drive was becoming a secondary priority compared to the health of his family, but he couldn’t move forward until he had the cash from his property in hand.

He didn’t have the time to deal with the traditional real estate “dance”:

- No time for 60+ days of showings and open houses.

- No energy to haggle over inspection repairs.

- No patience for “bank-approved” buyers who might fall through at the last minute.

Brandon needed a Dayton house buyer who understood that speed wasn’t just a luxury—it was a necessity for his family’s well-being.

The Solution: Compassion, Speed, and a 3-Week Close

When Brandon reached out to EZ Sell Homebuyers, I knew this wasn’t just a real estate transaction; it was a rescue mission.

How we made the transition easy for Brandon:

- 3-Week Closing: We moved from our first meeting to a full cash closing in just 21 days, giving Brandon the liquidity he needed to move.

- Post-Closing Occupancy: We knew Brandon had a lot on his plate. To help him focus on his mother, we gave him extra time to move out after the closing—rent-free—so he didn’t have to juggle a move and a family emergency at the same time.

- Bought 100% As-Is: Brandon didn’t have to clean out the garage or fix a single faucet. We took the house exactly as it sat on Cedar Knolls Drive.

The Outcome: Focusing on What Truly Matters

Brandon was able to transition into his mother’s home with cash in the bank and the weight of the Cedar Knolls property off his shoulders.

“Mike Wall understood my situation immediately. I needed to get to my mom, and I didn’t have time for the typical realtor games. Mike got me my cash in three weeks and even let me stay a little longer so I could handle the move without stress. If you need to sell your house fast in Dayton, Mike is the one with the heart and the speed to get it done.” — Brandon R., Dayton Homeowner

Why Pay Thousands In Agents Fees?

Why not request a Cash Offer from EZ Sell Homebuyers before you sign a 6-month listing agreement to sell your house with a realtor? We will get you an offer fast so you can make an informed decision about selling your home in Ohio. The entire process is 100% FREE, and there is no pressure to accept our offer. You have nothing to lose!

Compare selling to us vs. selling with a realtor

No obligation • Get your offer in 24 hours

Sell Your House in Ohio As-Is

Trying to sell a house the traditional way means buyer walkthroughs, a slow closing timeline, and paying fees or commissions. When you sell to us, you get a fair cash offer to buy your house.

Competitive Cash Offer

We have a solid understanding of market conditions in Ohio, so we are confident that you’ll get the best cash offer from us. You’ll be able to sell fast and with confidence.

Private Home Sale

Your house will sell fast with our private sale with a guaranteed outcome. Since we’re buying your home for cash, you won’t have to worry about the sale falling through because of financing issues.

Sell Without Fees

There are no fees or commissions when you sell to our cash house-buying company in Ohio. The offer you receive from us is the cash you’ll get at closing!

Sell Without Repairs

You won’t need to fix anything to sell to our team, regardless of the repairs needed. We’ll buy your property as-is and take care of any necessary work after the sale.

Sell Without Cleaning

Forget about cleaning. Take what you want and leave the rest. We buy your houses in as-is condition.

We Will Beat Any Offer

Did you receive an offer from another “We Buy Houses” company? Let us know! We will beat their offer.

“I tried listing my house 3 times. Every single time I was told to clean, fix, and repair, and I am just too old and too tired to do all that work. I found this company online, scheduled an appointment, made me an offer on the spot, signed the contract, and 2 weeks later I had my money. Wasted so much time and effort trying to list it. “

Tracey R. Canton.

Tracey R. Canton.

Cash For Houses In Ohio

We make selling your Ohio house for cash easy and stress-free. You can feel confident that your home will sell quickly without worrying about extra fees. Our team is dedicated to answering any questions you have before accepting our cash offer. We’ll handle necessary repairs and cleaning and address any issues with the house.

We Buy Homes Fast in Ohio

We Can Close Within 2 Weeks

But that doesn’t mean this is your only option. Need more time to plan? No Problem. Fill in the form now, get our offer, and pick your closing date.

Sell Without Repairs

Leaking roof? Crack in the foundation? Don’t worry! We love renovating houses. We’ll take care of it. Sell your house to us without touching a hammer or a paintbrush. Heck, don’t even worry about sweeping.

Sell Without Cleaning

Food in the fridge? Dirty socks on the floor? Believe us when we say, “We have seen worse.” We are not here to judge. We are here to make it easy and stress-free for you, so let us. Don’t worry about a thing. Take what you want, and leave the rest.

Sell Your House %100 Free

Our consultation, walkthrough, and offer are all free. We even pay your closing costs. Don’t forget: you are not obligated to accept our offer. There is nothing to lose; contact us today to see what we will offer for your house, in cash.

“I was very skeptical at first. They said they would buy my severely outdated home in cash, and it would all be taken care of in a matter of weeks. Well, I have got to tell you, they were amazing. They did exactly that, and they even helped me move. I couldn’t recommend them enough!”

Mary Budlock Columbus

Mary Budlock Columbus

Cash House Buyer Ohio

Selling your property to us in Ohio is super easy. We handle everything, so you don’t have to!

I’m Mike with EZ Sell Homebuyers, and we buy houses for cash! Let us take care of the heavy lifting and costly repairs. We will do our best to bring you an offer that works.

If you are looking for a company that buys houses for cash, contact us today. We will do whatever it takes to buy your house today and close on your timeline. In some cases, you might be able to sell your house in a matter of days after receiving our cash offer to buy your house. Contact us by phone or by filling out our online form, and we’ll take care of the rest. We provide the easiest way to sell a house fast, regardless of the condition.

It all starts with filling out the form below. There is absolutely no cost and no obligation to accept.

From “Offer” To “Closing” In A Matter Of Weeks, Not Months!

Listing with a realtor is not always the best solution. When for whatever reason you would rather sell directly to a buyer with the cash to close fast, reach out to us. Foreclosure, behind on taxes or mortgage, or even when the property is inhabitable, we won’t flinch. We buy houses in Ohio, no matter the reason or condition the house is in.

We Buy Houses Fast In Ohio

We never charge fees to buy your house from you. When you sell to us, you keep all the cash in our offer. You also never have to spend time haggling over a commission structure or take other steps before negotiating the terms of the sale.

Before committing to a lengthy sales process, see how easy it is to get a cash offer from us. Forget about repairs, showings, and complicated negotiations. We’ll handle everything and can buy your house fast, no matter its condition.

When selling your Ohio house for cash, you won’t have to worry about strangers walking through it. We will come out to your property and determine our cash offer. After that, you can choose to accept our cash offer, and we can close at a reputable title company.

Local House Buyers In Ohio

We are local house buyers helping homeowners all over Ohio sell for cash. To get the process started, just fill out our short form, or give us a call at (937) 598-2274. Sell your house fast in Ohio! Skip the hassle and jump straight to the cash offer for your house. See our testimonials!

Where We Buy Houses Ohio

We’re a trusted local cash house buyers in Ohio. We buy houses in any condition or situation. We offer cash for houses, so you can sell your house in Ohio fast in as little as 7 days.

If you have a house you want to sell for cash in Ohio, we buy it! Stop dealing with costly repairs, open houses, cleaning, and all the headaches! We take care of everything; you just take what you want and leave the rest to us! Sell your house in Ohio fast for cash today!

Sell My House Fast Ohio

• Ohio

• Akron

• Cincinnati

We Buy Houses Ohio

• Springfield

• Toledo

• Xenia

Homeowners All Over Ohio Loved Our Offers, And So Will You

I’ve never work with more professional investors… if you value honesty and a no BS approach to business… you’ll love this company… I highly recommend them!

This is a great company to work with. We got a postcard in the mail and we were interested in selling our property. They are very professional upfront and honest on everything.

Your professionalism, punctuality and honesty is second to none. You give priority to your customers. Keep up the good work. I will recommend EZ Sell Homebuyers all day every day

Selling a House for Cash in Ohio FAQ’s

How do I know if a cash offer for my house is legitimate?

A legitimate cash buyer will clearly explain their process, provide a written offer, and offer a realistic closing timeline. At EZ Sell Homebuyers, we’ve been buying houses across Ohio for over 25 years, have closed more than 1,700 transactions, and maintain an A+ BBB rating with 67 five-star Google reviews. We never charge fees or commissions.

What are the benefits of accepting an all-cash offer for my house?

An all-cash offer reduces risk, speeds up the sale, and eliminates financing delays. There’s no lender approval, fewer contingencies, and you can often close in as little as 7–14 days. Cash sales are ideal for homeowners who want certainty, flexibility, and a fast closing.

Are there any downsides to selling a house for cash?

Some cash buyers charge hidden fees or renegotiate after inspections. That’s why it’s important to work with a reputable local buyer. EZ Sell Homebuyers provides transparent offers upfront, covers typical closing costs, and never surprises sellers with last-minute deductions.

What is the fastest way to sell a house in Ohio?

The fastest way to sell a house in Ohio is to work with a local cash home buyer. Cash sales avoid agent showings, repairs, and bank delays. With EZ Sell Homebuyers, you can request a no-obligation offer, accept when ready, and choose a closing date that fits your timeline.

Do I need to make repairs before selling my house for cash?

No. We buy houses as-is, including properties that need repairs, are vacant, inherited, or facing foreclosure. You don’t need to clean, fix anything, or prepare the home for showings.

We Buy Houses Fast in All Ohio Cities

We’re based in Dayton and have proudly served the Ohio community since 2015, closing over 1,700 transactions. We leverage our in-depth local knowledge of the Ohio housing market to ensure you receive the best all-cash offer possible and sell your home fast.

We buy houses all over the state of Ohio and surrounding communities, including but not limited to the following major regions:

Southwest Ohio, Central Ohio, Northeast Ohio, Northwest Ohio, and Southeast Ohio.

We buy houses in Dayton, Akron, Cincinnati, Cleveland, Columbus, and Toledo, along with surrounding cities, suburbs, and rural communities throughout the state. We also purchase houses throughout all of Ohio, so no matter where your property is located, we can help.

Sell your house fast in Ohio — even if your property is outside these locations. We’d be happy to make you a no-obligation cash offer today.

If you’re ready to sell your home for cash, call us at (937) 598-2274. Our team is here to guide you through the process and get you a great offer on your home.